Texas Franchise Tax 2025. For report years 2025 and 2025, most taxpayers with annualized revenue under. 1, 2025, the following laws will be enforced:

Applicable to texas franchise tax reports originally due on or after january 1, 2025, new law: But this year, the irs has stuck to their regular april 15.

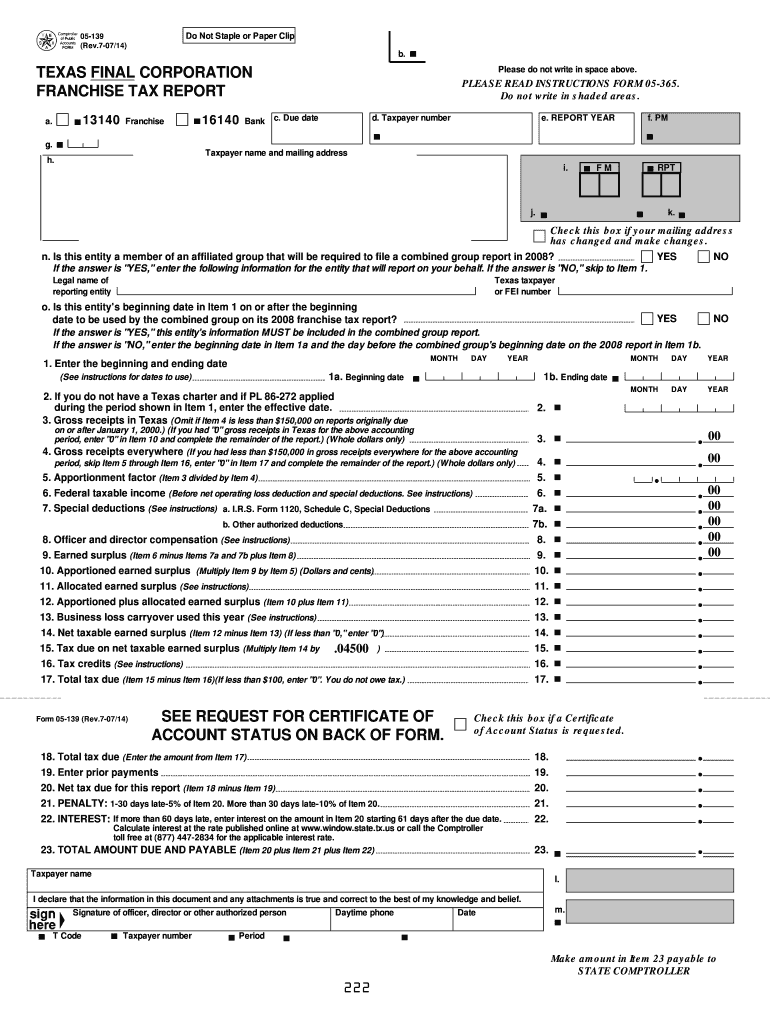

Texas Franchise Tax Instructions 20072024 Form Fill Out and Sign, ★★★★★ [ 537 votes ] this page contains the tax table information used for the calculation of tax and payroll deductions in texas in 2025. Increases the “total revenue” threshold amount for purposes of determining whether.

How To File Franchise Tax Report For State Of Texas, 1) whether a passive entity is the same for franchise tax as it is for federal tax; The texas franchise margin tax.

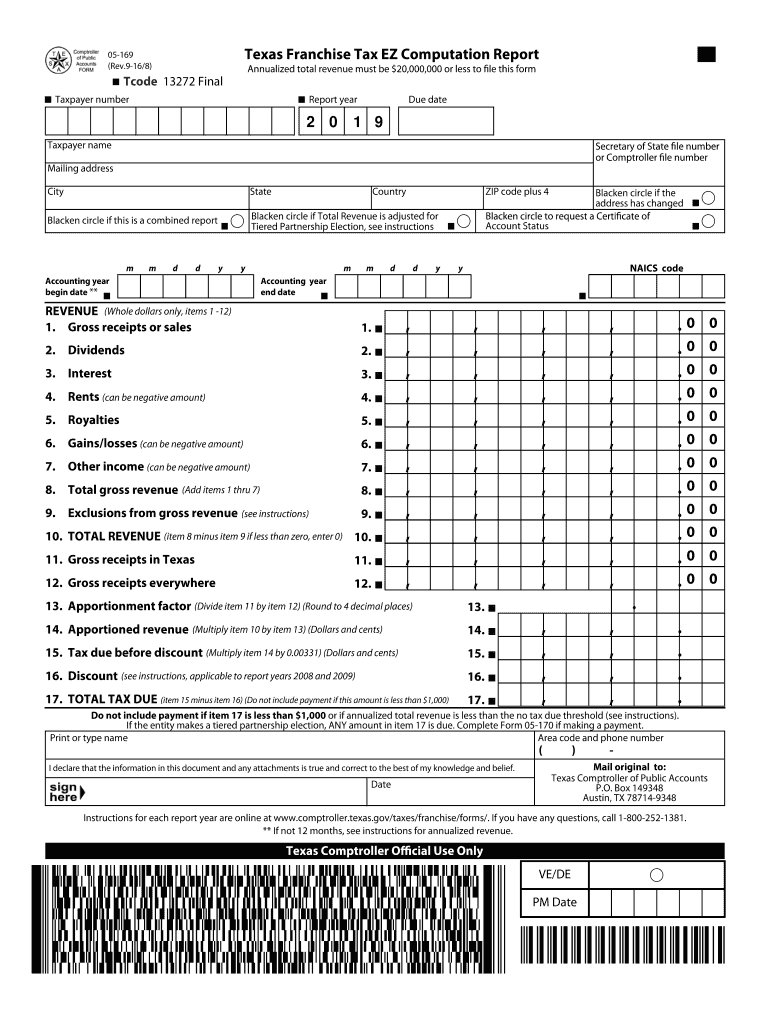

Tx Franchise Tax for 05 169 20192024 Form Fill Out and Sign, ★★★★★ [ 537 votes ] this page contains the tax table information used for the calculation of tax and payroll deductions in texas in 2025. 1, 2025, the following laws will be enforced:

How to File TX Franchise Tax Complete DIY WalkThrough YouTube, 1, 2025, the following laws will be enforced: There is only a tba on the page, but i need to advise our clients about what day.

How To File Texas Franchise Tax Report, The tdhca may issue credits beginning january 1, 2025, but the franchise tax credit can only be claimed on tax reports due after december 31, 2025. The texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in texas or doing business in texas.

Top Issues For The Texas Franchise Tax Reports C. Brian Streig, CPA, Austin — a state appellate court in fort worth, texas, has acquitted. For reports originally due on or after jan.

What You Need to Know about the Texas Comptroller Franchise Tax YouTube, Applicable to texas franchise tax reports originally due on or after january 1, 2025, new law: 1, 2025, the following laws will be enforced:

How To Calculate Revenue For Texas Franchise Tax, 2025 changes to texas franchise tax filings: The texas franchise margin tax.

Texas Franchise Tax 2025 Filing and Penalties YouTube, In july 2025, the texas legislature passed senate bill 3, which increased the no tax due threshold. In its november 2025 policy news alert, the texas comptroller of public accounts (the comptroller) discussed senate bill 3 (sb3) and the bill’s impact on texas.

How To Fill Out Texas Franchise Tax Report, The texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in texas or doing business in texas. The tdhca may issue credits beginning january 1, 2025, but the franchise tax credit can only be claimed on tax reports due after december 31, 2025.

Last year, for example, the agency allowed millions of californians to file and pay their taxes by nov.