Hsa Savings Limits 2025. Savers age 55 and over can contribute an. Hsa members can contribute up to the annual maximum amount that is set by the irs.

Right now, hsas max out at $3,850 for individuals and $7,750 for families. Health savings accounts are already an unsung hero of saving money in an account for medical expenses without paying taxes on those funds.

2025 HSA & HDHP Limits, Savers age 55 and over can contribute an. Plus, participants who are age 55 and older can save an.

2025 HSA Contribution Limits Claremont Insurance Services, In 2025, an hdhp is one with a minimum deductible of $1,600 for individual coverage and. In 2025, these limits will rise to $4,150 and $8,300,.

IRS Announces Updated HSA Limits for 2025 First Dollar, Irs raises hsa limit for 2025 with record increase. Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families.

New HSA/HDHP Limits for 2025 Miller Johnson, Annual health savings account contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16: Savers age 55 and over can contribute an.

.png)

Significant HSA Contribution Limit Increase for 2025, You can’t be claimed as a dependent on someone else’s tax return. Health savings account (hsa) and flexible spending account (fsa) contribution limits for 2025 are.

IRS Issues 2025 HSA and EBHRA Limits Innovative Benefit Planning, In 2025, an hdhp is one with a minimum deductible of $1,600 for individual coverage and. Hsa members can contribute up to the annual maximum amount that is set by the irs.

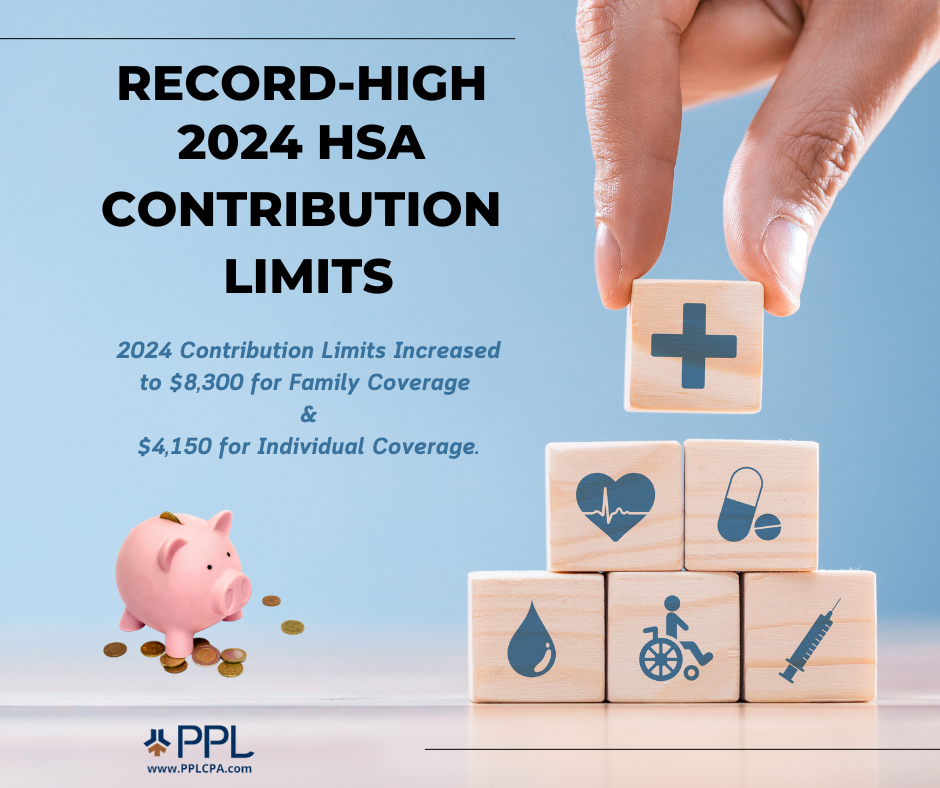

IRS Announces 2025 HSA Limits Inova Payroll, The new 2025 hsa contribution. For 2025, the maximum hsa contribution will jump to $8,300 for a family and $4,150 for an individual.

IRS Announces HSA and High Deductible Health Plan Limits for 2025, For 2025, the maximum hsa contribution will jump to $8,300 for a family and $4,150 for an individual. Hsa contribution limits for 2025 are $4,150 for singles and $8,300.

RecordHigh 2025 HSA Contribution Limit PPL CPA, Health savings accounts are already an unsung hero of saving money in an account for medical expenses without paying taxes on those funds. Health savings account (hsa) and flexible spending account (fsa) contribution limits for 2025 are.

What Are The Hsa Limits For 2025 Irs Gov Amata Bethina, Hsa contribution limits for 2025. The irs announced one of the most significant increases to the maximum health savings account contribution limits for 2025.